Fit2Trade

The Complete Digital Compliance Solution for Credit Unions

Achieve CBI compliance, streamline health & safety, and demonstrate strong governance – all through one easy-to-use portal.

One app. Multiple solutions.

Specifically deigned for the unique needs of Irish Credit Unions. The solutions you need for you team and premises.

Ensure.

Health & Safety Management System

Get your up-to-date Safety Statement, an Annual Audit and a complete H&S Management system to ensure compliance.

Educate.

Learning Management System

Online compliance training courses that are tailored to Irish Credit Unions and cover your legal requirements. Includes MCC Tracker.

Execute.

Operational Management App

Guarantee consistent standards, ensure safe checks are completed, and simple operational checks across all your locations.

Regulatory Compliance courses for Credit Union employees

H&S courses for Credit Union employees

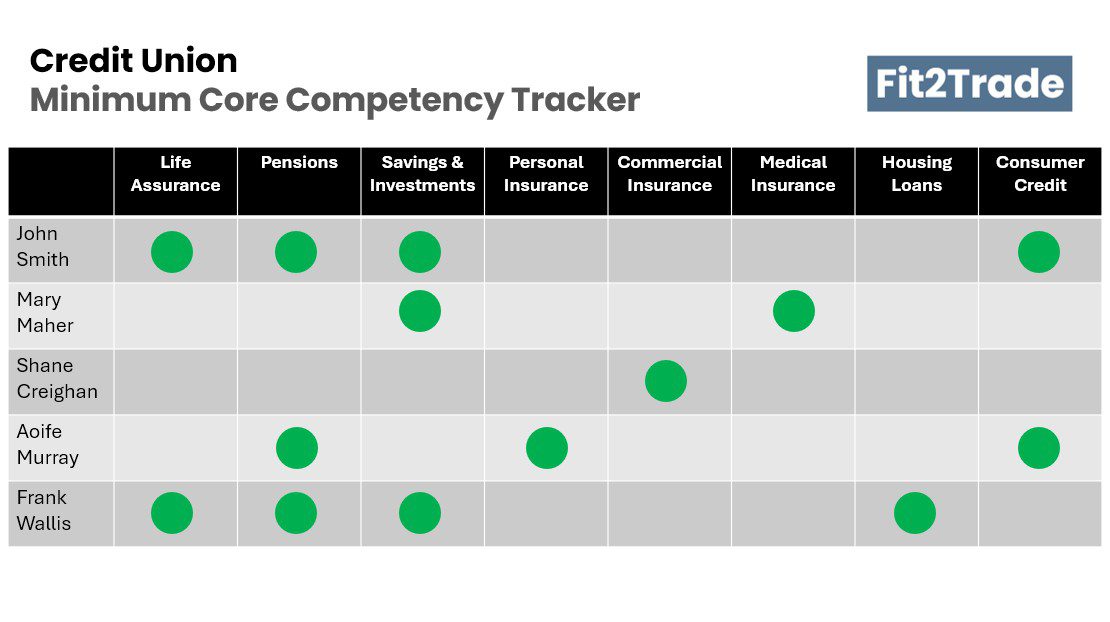

Minimum Core Competency Tracker

The MCC now includes Credit Unions, requiring staff involved in savings, investments, and lending to obtain qualifications set by the Central Bank of Ireland. With Fit2Trade, you can easily track MCC qualifications, identify gaps, and provide evidence of proactive compliance to the CBI. The deadline for acquiring these qualifications is the 1st October 2028.

Life Assurance

Track employee completion of CBI-recognised qualifications.

Acceptable qualifications:

Qualified Financial Adviser

Member, Associate or Fellow of the Irish Institute of Pensions Management

Accredited Product Adviser (Life Assurance)

Certificate in Personal Financial Planning with the Personal Financial Planner designation

Accredited Product Professional (Life Assurance)

Pensions

Track employee completion of CBI-recognised qualifications.

Acceptable qualifications:

Qualified Financial Adviser

Member, Associate or Fellow of the Irish Institute of Pensions Management

Accredited Product Adviser (Pensions)

Certificate in Personal Financial Planning with the Personal Financial Planner designation

Accredited Product Professional (Retirement Benefits)

Savings and Investments

Track employee completion of CBI-recognised qualifications.

Acceptable qualifications:

Qualified Financial Adviser

Member, Associate or Fellow of the Irish Institute of Pensions Management

Registered Stockbroker

Accredited Product Adviser (Savings and Investments)

Certificate in Personal Financial Planning with the Personal Financial Planner designation

Accredited Product Professional (Savings and Investment)

Accredited Financial Practitioner

Advanced Certificate in Credit Union Practice (Term Deposits)

Pathways Diploma in Credit Union Practice (Term Deposits)

Credit Union Adviser (Term Deposits)

Personal General Insurance

Track employee completion of CBI-recognised qualifications.

Acceptable qualifications:

Certified Insurance Practitioner

Associate or Fellow of the Chartered Insurance Institute

Accredited Product Adviser (Personal General Insurance)

Accredited Product Professional (Personal General Insurance)

Accredited Practitioner (Personal General Insurance)

Accredited Financial Practitioner

Commercial General Insurance

Track employee completion of CBI-recognised qualifications.

Acceptable qualifications:

Certified Insurance Practitioner

Associate or Fellow of the Chartered Insurance Institute

Accredited Product Adviser (Commercial General Insurance)

Accredited Product Professional (Commercial General Insurance)

Private Medical Insurance and Associated Insurances

Track employee completion of CBI-recognised qualifications.

Acceptable qualifications:

Certified Insurance Practitioner

Associate or Fellow of the Chartered Insurance Institute

Diploma in Private Medical Insurance

Accredited Product Adviser (Personal General Insurance)

Accredited Product Adviser (Private Medical Insurance)

Accredited Product Professional (Private Medical Insurance)

Accredited Product Professional (Personal General Insurance)

Housing Loans, Home Reversion Agreements and Associated Insurances

Track employee completion of CBI-recognised qualifications.

Acceptable qualifications:

Qualified Financial Adviser

Accredited Product Adviser (Loans)

Certificate in Personal Financial Planning with the Personal Financial Planner designation

Accredited Product Professional (Loans)

Accredited Practitioner (Loans)

Accredited Financial Practitioner

Consumer Credit and Associated Insurances

Track employee completion of CBI-recognised qualifications.

Acceptable qualifications:

Qualified Financial Adviser

Accredited Product Adviser (Loans)

Accredited Product Adviser (Consumer Credit)

Certificate in Personal Financial Planning with the Personal Financial Planner designation

Accredited Product Professional (Loans)

Accredited Practitioner (Loans)

Accredited Financial Practitioner

Advanced Certificate in Credit Union Practice

Pathways Diploma in Credit Union Practice

Credit Union Adviser

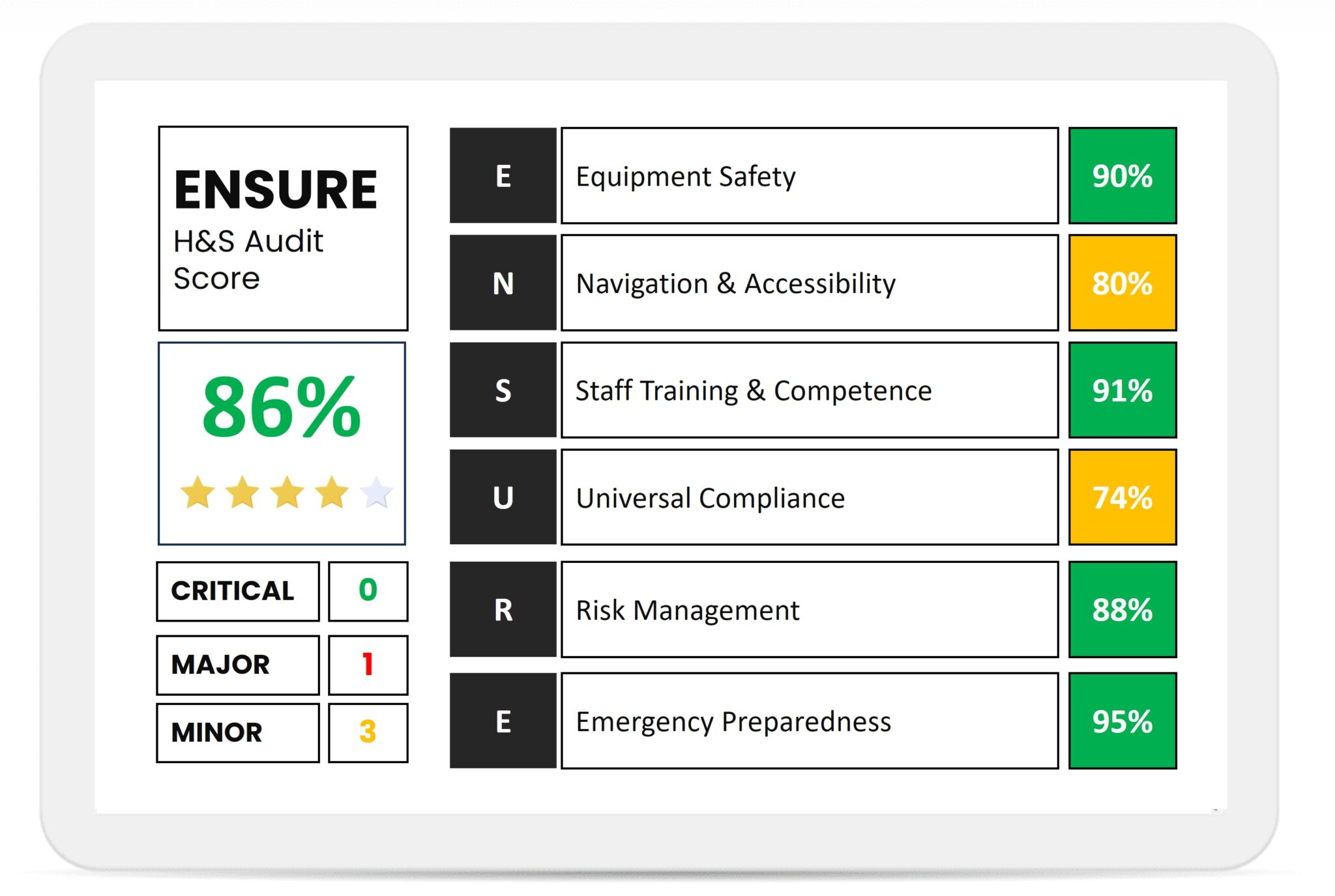

Health & Safety Audits

The ENSURE Health and Safety audits are expert assessments of your H&S policies, systems and procedures to ensure you’re compliant and operating safely.

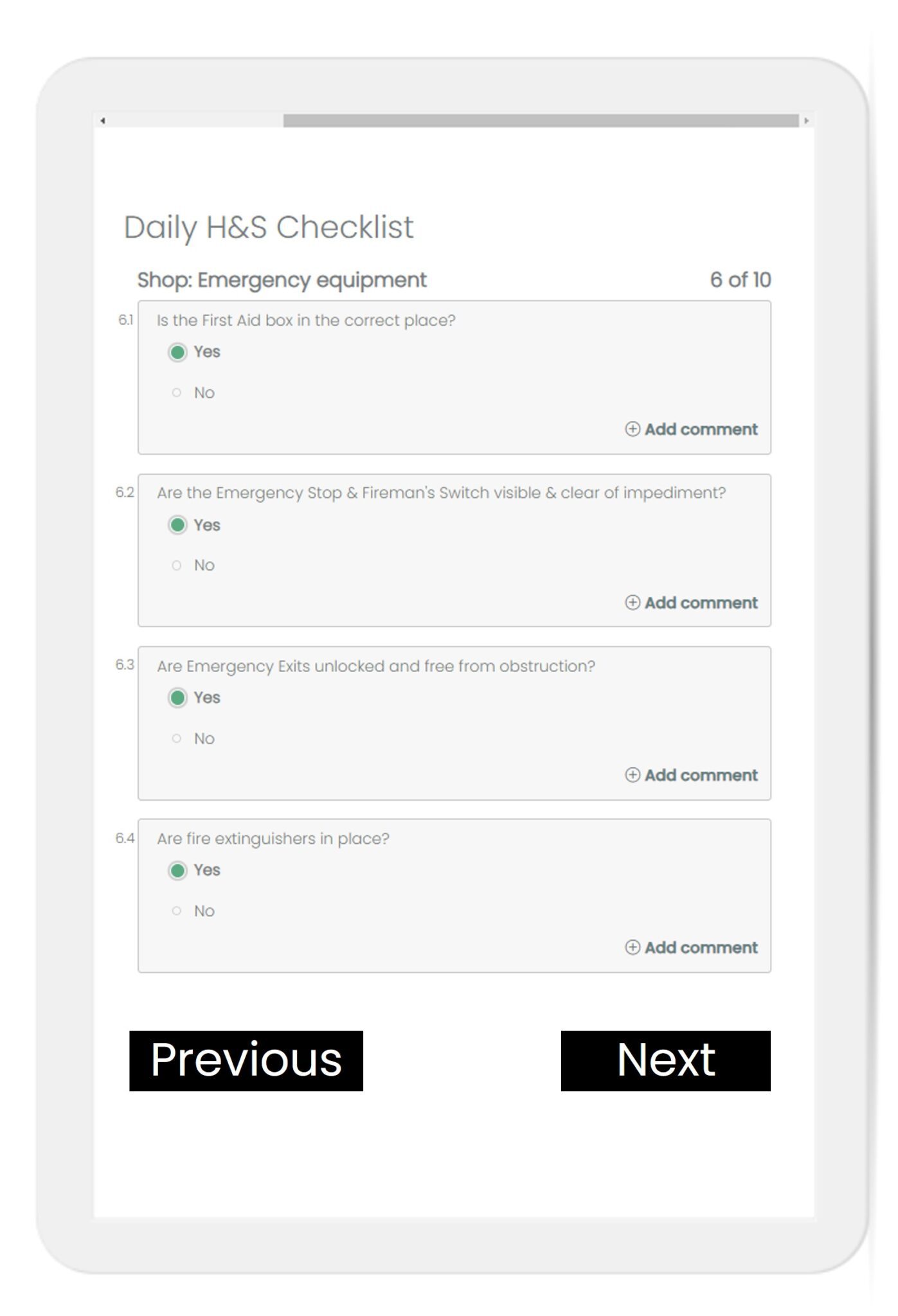

Digital Routines and Checklists

Get real-time visibility of the completion of all H&S checks. We digitize your paper Daily, Weekly, and Monthly checks so they’re completed on mobile.

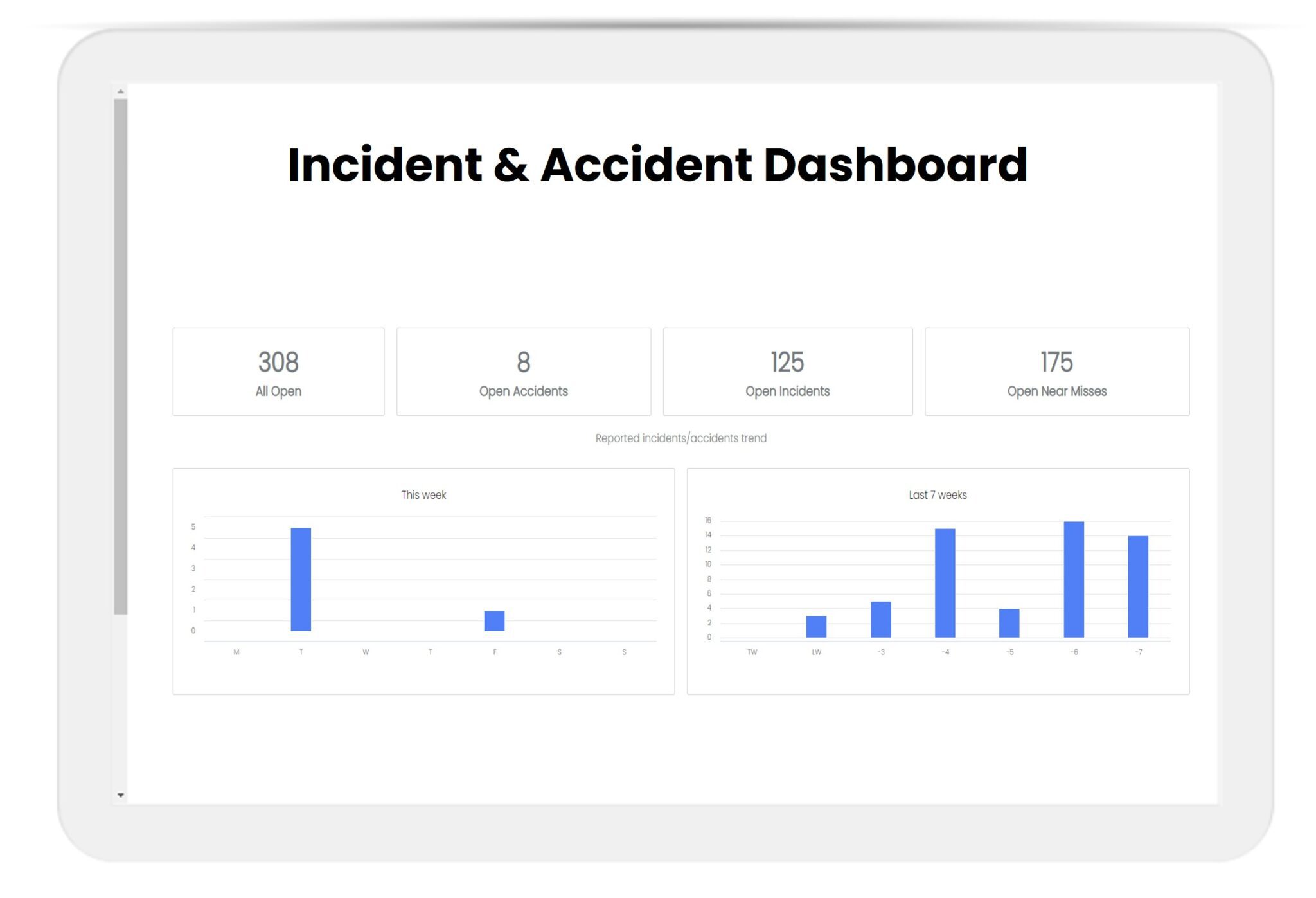

Incident & Accident Management

Efficiently report and manage all incidents / accidents with our comprehensive software. Streamline your response and processes for a safer workplace.

Corrective Action Management

Our cloud-based CAPA management system allows credit unions to track customer complaints, safety issues from routines and audit actions.

Reduce Errors and Prevent Loss

Loss Prevention Routines

Remove Excel and Paper

We digitize and schedule your existing Loss Prevention checks to minimise and prevent loss, giving Head Office instant visibility.

PCI Compliance Checks

Avoid Hefty Fines

We take the guesswork and hassle out of PED reporting, as well as ensuring all PEDs are checks for tampering signs each week.

Routine Safe Checks

Instantly Identify Shortages

By digitising your Monthly cash count and sending collated data to Head Office, we remove all the manual processes and emails.

Pricing for your Credit Union

Credit Union

price per location*- Includes for each Credit Union

- Training for all employees

- 1. Regulatory & Data Compliance: Showcase robust governance, protect member data, and ensure compliance with CBI requirements and data privacy best practices.

- 2. MCC: Easily track MCC qualifications, identify gaps, and provide evidence of proactive compliance.

- 3. Health & Safety Compliance: Keep your team current with the latest health and safety regulations.

- H&S

- 1. Annual Health & Safety Audits: Let us handle your audits to ensure compliance and peace of mind.

- 2. Comprehensive Safety Statement: Stay compliant with a professionally crafted, up-to-date safety statement.

- 3. Incident & Accident Reporting: Minimise risks and lower insurance costs with our efficient reporting module.

- Operations

- 1. Loss Prevention & PCI Compliance: Protect your assets and secure payment processes with structured routines and comprehensive compliance measures.

- 2. Digital Safe Checks: Ensure secure operations with automated, hassle-free checks.

- 3. ESG Reporting (2025): Demonstrate your commitment to sustainability and governance with transparent reporting.

*a location is each address that your business operates from.

Live demo.

Get to know the Fit2Trade solution in 15 minutes

You’ll get a personal tour of the platform, showcasing how it works for Irish Credit Unions. You’ll discover how you’ll be compliant with Safety Statements, Incident & Accident Reporting, Compliance Courses and more.